Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles

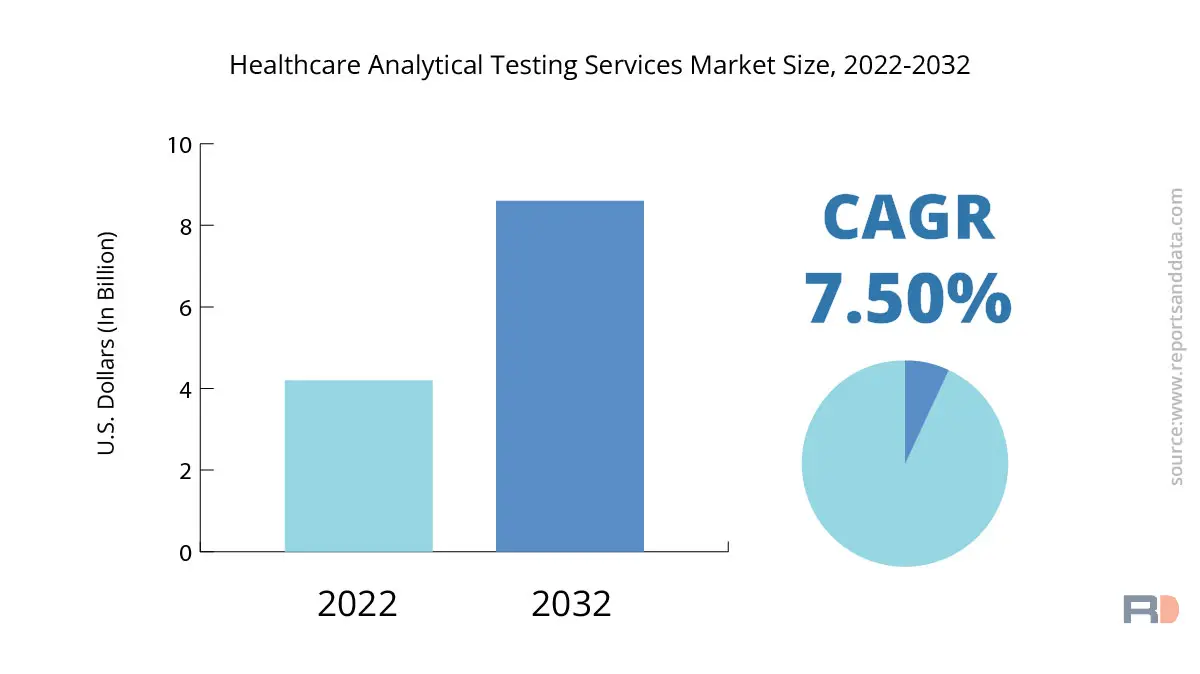

The global healthcare analytical testing services market size was USD 4.2 Billion in 2022 and is expected to reach USD 8.6 Billion by 2032, and register a rapid revenue CAGR of 7.5% during the forecast period.

Rising demand for analytical testing services in the pharmaceutical industry and increasing need for tailored treatment are major factors driving market revenue growth. Analytical testing services are required by the pharmaceutical sector for a number of reasons, including medication development, quality assurance, and regulatory compliance. Advanced analytical testing services are necessary for development of precision medicine to find biomarkers, diagnose diseases, and create focused treatments.

In addition, rising prevalence of chronic diseases, such as cancer, Diabetes, and Cardiovascular Diseases (CVDs), is another factor driving revenue growth of the market. Services for analytical testing are essential for identification, treatment, and control of various disorders. Also, need for analytical testing services for early disease identification and risk assessment is increasing by rising emphasis on preventative healthcare.

Moreover, rising use of cutting-edge technologies such as Metabolomics, Proteomics, and Genomics, is also expected to drive market revenue growth. These technologies are transforming the healthcare sector due to their ability to facilitate development of personalized medicine, precise diagnostics, and targeted therapeutics. Development and use of these technologies require analytical testing services.

Furthermore, increasing strict regulatory rules for development of pharmaceuticals and Medical Devices is also expected to drive market revenue growth. Pharmaceutical and Medical Device producers are required to carry out comprehensive analytical testing by regulatory organizations, such as Food and Drug Administration (FDA) and European Medicines Agency (EMA), to guarantee the security, effectiveness, and caliber of their goods.

However, high cost of testing services and lack of qualified workers are major factors, which could restrain market revenue growth. Healthcare items must undergo specialist analytical testing, which can be costly, especially for smaller businesses with tighter budgets. Some businesses may find it difficult to invest in testing services due to the expense, which can cause delays in product development and regulatory approval.

Bioanalytical testing, physical characterization, method development and validation, raw material testing, and other services can be classified as segments of the worldwide healthcare analytical testing services market based on service type. Due to the growing demand for Biologics and Biosimilars, which necessitate comprehensive testing for safety, efficacy, and quality assurance, the bioanalytical testing category had the greatest revenue share in the market in 2021. Additionally, clinical trials and research studies—both of which are critical for the processes of medication development and approval—need bioanalytical testing to be successful. As a result, it is anticipated that the bioanalytical testing sector will continue to rule the market over the projection period.

Throughout the projection period, the physical characterization segment is anticipated to post the quickest revenue Growth. Particle size, surface area, and polymorphism are among the physical and chemical characteristics of a drug substance or product that are analyzed during physical characterization testing. Physical characterization testing has become an essential step in the medication development and quality control procedures as a result of the complexity of therapeutic compounds and formulations. Also, the development of novel physical characterization methods has been necessitated by the introduction of new medication delivery systems and technology. The increased need for biopharmaceuticals and personalized treatment is also anticipated to fuel the expansion of the physical characterization market.

Another important service category in the market for healthcare analytical testing services is method development and validation. The development and validation of analytical techniques are covered in this section in order to guarantee the precision and dependability of test results. To guarantee that medications and biologics are high-quality, safe, and effective, method development and validation are crucial in the pharmaceutical and Biotechnology sectors. Over the forecast period, the growth of this segment is anticipated to be fueled by the rising number of drug approvals and the requirement for adherence to regulatory requirements.

Another significant service category in the market for healthcare analytical testing services is raw material testing. To ensure that the finished product fulfils the necessary criteria, raw materials used in the production of pharmaceuticals and biotechnology products must be examined for quality and purity. The detection and measurement of contaminants that may affect the final product's safety and effectiveness need the use of raw material testing. The increasing demand for high-quality raw materials and the stringent regulatory guidelines for their use are expected to drive the growth of this segment.

Pharmaceutical and biopharmaceutical firms, manufacturers of medical devices, contract research organizations, and other industries are the end-user segments of the global market for healthcare analytical testing services. The pharmaceutical and biopharmaceutical firms section was among them and held a sizable revenue share in 2021. It is anticipated that this segment will continue to rule during the projection period.

The growing emphasis on quality control and assurance in the procedures used to manufacture pharmaceuticals is the main factor driving the need for analytical testing services in the pharmaceutical and biopharmaceutical industry. Pharmaceutical product safety, quality, and efficacy are all dependent on analytical testing. The need for analytical testing services in this market has increased as a result of the rising prevalence of chronic diseases and the growing desire for personalized treatment.

Throughout the forecast period, the medical device businesses section is anticipated to increase significantly. Medical device safety and effectiveness are crucially dependent on analytical testing. There is a growing need for analytical testing services in this market due to the complexity of medical devices and the increased focus on patient safety.

Throughout the projection period, the contract research organizations (CROs) market is also anticipated to have considerable expansion. CROs offer a wide range of services to pharmaceutical and biopharmaceutical firms, such as regulatory support, data analysis, and clinical trial management. In order to guarantee the security and effectiveness of medication candidates in clinical trials, analytical testing services are essential. The need for analytical testing services in this market is predicted to rise as drug development operations are increasingly outsourced to CROs.

Government organizations, forensic labs, and academic and research institutes are included in the others category. Although this area now has a tiny revenue share, it is anticipated to grow significantly over the course of the projected period. The demand for analytical testing services in this market is anticipated to be driven by the growing emphasis on research and development activities in the healthcare sector and the rising need for forensic testing services.

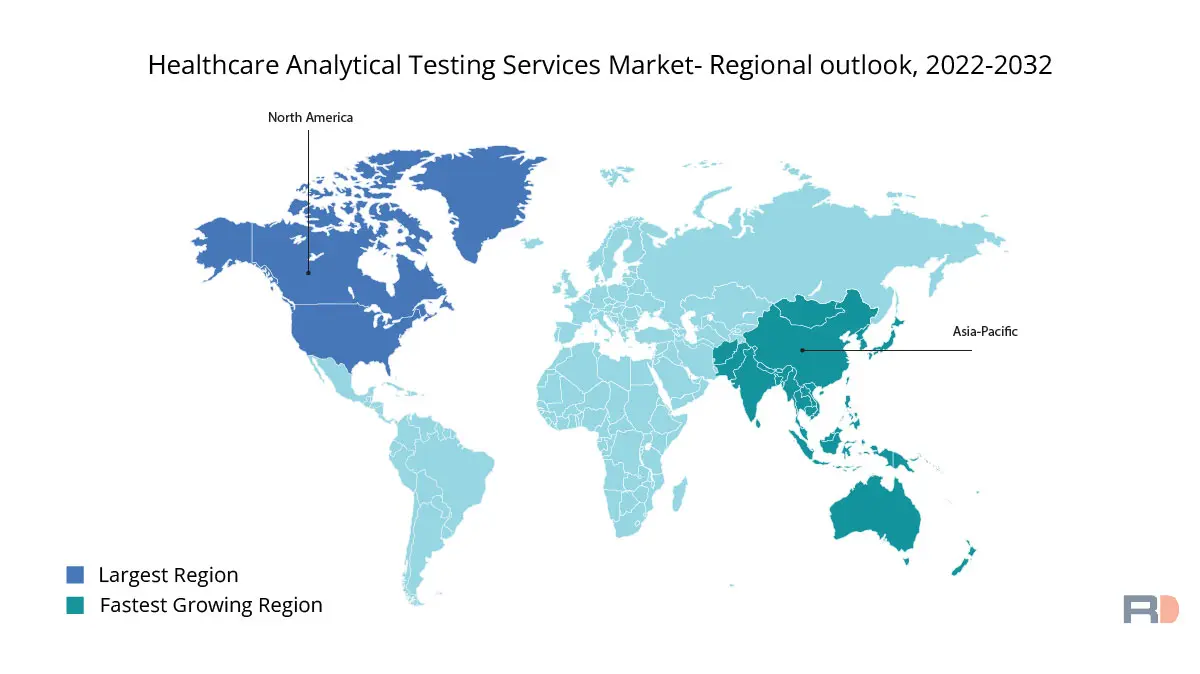

Over the forecast period, the Healthcare Analytical Testing Services market is anticipated to be dominated by the North American region. Due to the existence of well-established pharmaceutical and biotechnology businesses, the rising number of R&D initiatives, and the rising demand for advanced analytical testing services, the region is predicted to have the greatest market revenue share. Also, the FDA and other regulatory bodies' existence contribute significantly to the market's expansion in North America. Given that the FDA is in charge of overseeing and approving all pharmaceuticals and medical devices, there is a demand for analytical testing services in the area. The demand for analytical testing services in the region is also anticipated to increase as a result of the rising desire for personalized medicine and the appearance of new drug development technologies, including gene and cell therapies.

Over the projection period, the European area is anticipated to be the second-largest market for healthcare analytical testing services. Increased demand for advanced analytical testing services, an increase in the number of regulatory approvals for new medications and medical devices, and an increase in the number of clinical trials and research activities are the main factors driving market expansion in this area. Additionally, the market is anticipated to develop due to the presence of well-established pharmaceutical and biotechnology businesses in Europe and the region's increasing demand for analytical testing services. In addition, it is projected that the adoption of cutting-edge analytical testing technologies, such as liquid chromatography-mass spectrometry (LC-MS), and the implementation of strict laws related medication licensing will increase demand for analytical testing services in the area.

Throughout the forecast period, the healthcare analytical testing services market is anticipated to grow most quickly in the Asia Pacific region. The rising need for cutting-edge healthcare facilities, an increase in the number of contract research organizations (CROs), and an increase in the number of clinical trials in the area are the main factors driving market expansion in this area. Additionally, it is anticipated that the market in the region will increase as a result of the rising prevalence of chronic diseases and the rising desire for personalized medication. Also, a sizable pool of qualified workers and the implementation of cutting-edge analytical testing technologies, such mass spectrometry (MS) and high-performance liquid chromatography (HPLC), are anticipated to further propel market growth in the area.

Healthcare analytical testing services market, it is an essential sector that provides necessary testing services to ensure the safety and efficacy of pharmaceutical products. The global healthcare analytical testing services market is highly competitive, with a few large players dominating the market. The major players in this market include:

These companies have a significant market share, and they use various strategies such as mergers and acquisitions, collaborations, and new product launches to stay competitive.

This report offers historical data and forecasts revenue growth at a global, regional, and country level, and provides analysis of market trends in each of segments and sub-segments from 2019 to 2032. For the purpose of this report, Reports and Data has segmented the global healthcare analytical testing services market based on service type, end-use, and region:

| PARAMETERS | DETAILS |

| The market size value in 2022 | USD 4.2 Billion |

| CAGR (2022 - 2032) | 7.5% |

| The Revenue forecast in 2032 |

USD 8.6 Billion |

| Base year for estimation | 2022 |

| Historical data | 2020-2021 |

| Forecast period | 2022-2032 |

| Quantitative units |

|

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Service Type Outlook, End-use Outlook, Regional Outlook |

| By Service Type Outlook |

|

| By End-use Outlook |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America ; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; France; BENELUX; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; Turkey |

| Key companies profiled | Lonza Group AG, Charles River Laboratories International Inc, Catalent Inc, PPD Inc, Thermo Fisher Scientific Inc, Element Materials Technology Group Limited, WuXi AppTec Group, Merck KGaA, Exova Group Limited, Almac Group |

| Customization scope | 10 hrs of free customization and expert consultation |

Facing issues finding the exact research to meet your business needs? Let us help you! One of our Research Executives will help you locate the research study that will answer your concerns. Speak to Analyst Request for Customization

Request a FREE Sample here to understand what more we have to offer over competition…

upto20% OFF

upto20% OFF

Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles