Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles

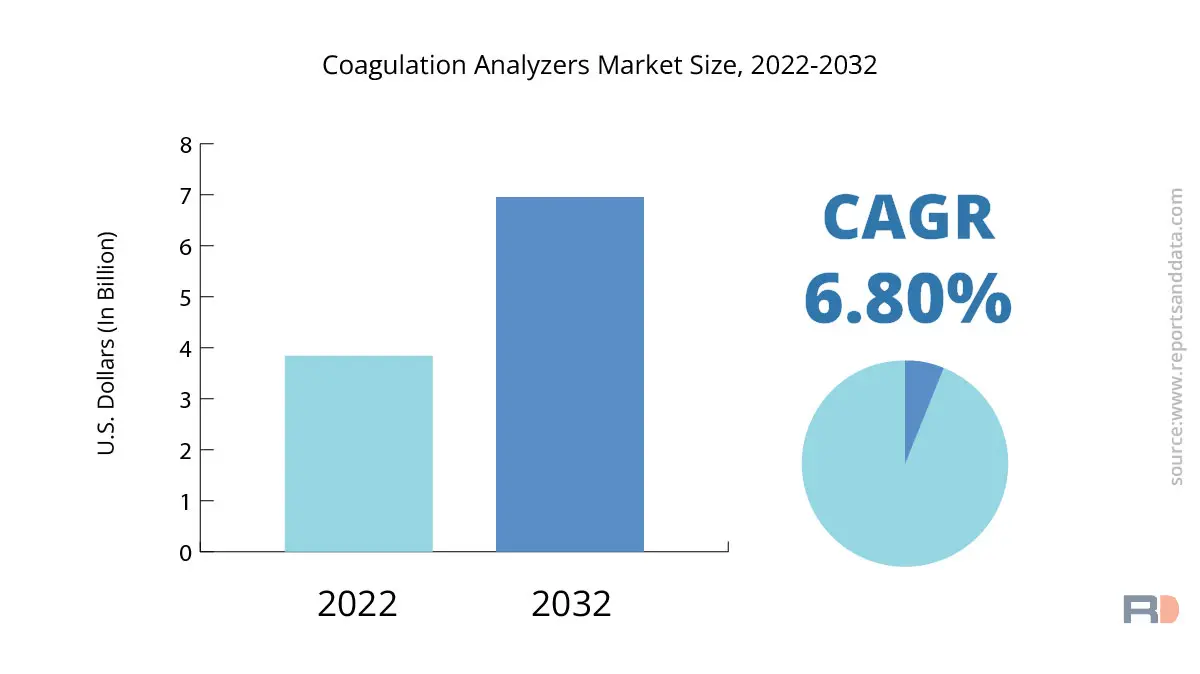

The global coagulation analyzers market size was USD 3.84 Billion in 2022 and is expected to reach USD 6.95 Billion in 2032, and register a revenue CAGR of 6.8% during the forecast period. Rising demand for point-of-care testing, increasing prevalence of blood diseases, and technological developments in coagulation analyzers are major factors driving market revenue growth.

One of the main factors driving revenue growth of the coagulation analyzers market is increasing prevalence of blood disorders such as thrombophilia, Hemophilia, and Von Willebrand Disease. The disease primarily affects men and affects 20,000 Americans, according to the Centers for Disease Control and Prevention (CDC). In addition, it is expected that demand for coagulation analyzers would be driven by rising prevalence of cancer, cardiovascular illnesses, and other chronic conditions that require anticoagulant therapy.

Another factor driving revenue growth of the market is rising demand for point-of-care testing. Diagnostic testing that is carried out at or close to the location of patient care without the need for specialist laboratory equipment or trained personnel is referred to as point-of-care testing. Adoption of point-of-care testing is driving need for quick detection and treatment of blood disorders, which is creating high demand for coagulation analyzers.

Coagulation analyzer technological developments are also driving revenue growth of the market. Coagulation analyzers have become more precise and effective as a result of the incorporation of microfluidic technology and automation. For instance, the Sysmex CS-5100 System from Siemens Healthineers is a fully automated coagulation analyzer that provides prompt and accurate results for a range of coagulation tests. Rising use of such innovative coagulation analyzers is expected to drive revenue growth of the market.

Demand for coagulation analyzers is also expected to be driven by rising elderly population. The United Nations predicts that by 2050, there will be 2.1 billion elderly people across the globe. Need for coagulation analyzers is expected to increase since aged population is increasingly sensitive to blood abnormalities and chronic illnesses.

However, high price of coagulation analyzers and the scarcity of qualified professionals are major factors, which could restrain revenue growth of the market. In addition, rising demand for refurbished and used coagulation analyzers could hamper revenue growth of the market to some extent.

In terms of revenue, the standalone analyzer market accounted for a sizeable portion of the overall coagulation analyzers market in 2021. Based on the kind of product, the market has been divided into standalone analyzers and integrated analyzers. Hospitals, diagnostic labs, and research facilities all like standalone analyzers because of how simple they are to use and how accurate the findings of coagulation tests are. Additionally, standalone analyzers give the end-users the freedom to personalise and choose particular assays for coagulation analysis. This functionality allows end-users to perform a variety of coagulation tests on a single platform and is very helpful for research purposes.

Throughout the projection period, the integrated analyzer segment is anticipated to post a higher revenue CAGR. Technology advances and rising demand for integrated solutions in coagulation testing are anticipated to be the main drivers of revenue growth. Integrated analyzers combine several tasks into a single machine, including haematology, chemistry, and coagulation analysis. Because of this integration, end users' total cost of ownership, space needs, and operating expenses are reduced. The growing trend of healthcare consolidation, which results in the centralization of laboratory operations and the requirement for high-throughput testing, is predicted to raise the market for integrated analyzers.

Another element that is anticipated to fuel the expansion of the integrated analyzer industry is the integration of coagulation analyzers with laboratory information management systems (LIMS). Automated data management, interpretation of the results, and report production are provided by integrated analyzers, which increases workflow efficiency and decreases errors. The use of integrated analyzers in clinical laboratories and hospitals is anticipated to rise as a result of these benefits.

The ability of blood to clot is measured by coagulation analyzers, which are also used to track anticoagulation medication. These tools are used to identify several coagulation disorders, including thrombophilia, von Willebrand disease, and haemophilia. The prothrombin time (PT), activated partial thromboplastin time (APTT), D-dimer, fibrinogen, and other tests are some of the test types that are segmented in the global market for coagulation analyzers.

Throughout the anticipated period, the PT test type is anticipated to account for the biggest market share for coagulation analyzers. The time it takes for blood to clot is measured by the PT test, which is also used to monitor warfarin medication and evaluate liver function. The demand for PT testing is anticipated to rise as coagulation problems including deep vein thrombosis and pulmonary embolism become more common. Also, it is anticipated that the ageing population and an increase in surgical operations will support market expansion.

Throughout the projected period, the APTT test type is anticipated to grow at the quickest rate. The intrinsic coagulation pathway is measured by the APTT test, which is also used to monitor heparin therapy and identify coagulation abnormalities. The demand for APTT tests is anticipated to rise as haemophilia and von Willebrand disease become more common. Also, the increase in diagnostic methods and the increased understanding of early disease diagnosis are anticipated to support market expansion.

Throughout the projected period, the D-dimer test type is also anticipated to have significant increase. Deep vein thrombosis and pulmonary embolism are two examples of thrombotic illnesses that can be diagnosed with the D-dimer test, which analyses the presence of fibrin breakdown products in the blood. The demand for D-dimer tests is anticipated to rise as thrombotic illnesses become more common, especially among the older population. Additionally, it is anticipated that increased consumer awareness of the value of early disease diagnosis will support market expansion.

Throughout the projected period, the fibrinogen test type is anticipated to expand steadily. The blood amount of fibrinogen is measured by the fibrinogen test, which is used to identify and track a variety of clotting problems. The need for fibrinogen testing is anticipated to be driven by the rising incidence of cardiovascular disorders and the increase in diagnostic procedures. Also, it is anticipated that the ageing population and an increase in surgical operations will support market expansion.

Thrombin time and reptilase time are two other test kinds that are anticipated to experience considerable expansion during the projected period. Many coagulation abnormalities, including factor deficiency and platelet function problems, are diagnosed with these assays.

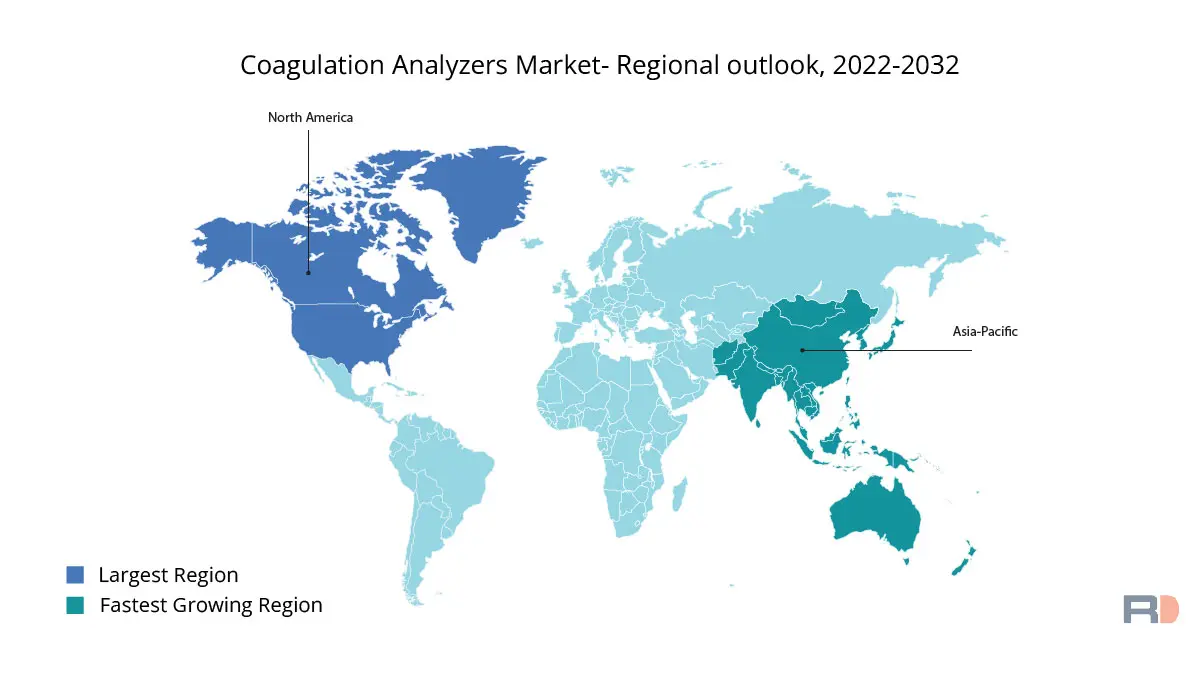

Throughout the projected period, North America is expected to dominate the global market for coagulation analyzers in terms of revenue share. This can be related to the region's growing senior population and the rising prevalence of various blood illnesses. Deep vein thrombosis (DVT) and pulmonary embolism (PE) harm about 900,000 people yearly in the United States, according to the Centers for Disease Control and Prevention (CDC). In addition, the region is home to some of the market's leading players for coagulation analyzers, which is predicted to fuel further market expansion.

Due to the rising frequency of blood disorders and the increased need for sophisticated coagulation testing equipment in the region, Europe is anticipated to account for a sizeable portion of the global market for coagulation analyzers. The healthcare sector in the area is expanding significantly, and as a result, there are more hospitals and diagnostic facilities, which is likely to increase demand for coagulation analyzers. Also, the region's market is anticipated to increase as a result of the rising geriatric population and the growing need for point-of-care testing equipment.

The market for coagulation analyzers in Asia Pacific is anticipated to develop at the fastest rate over the prediction period. This can be due to the rising occurrence of blood illnesses in developing nations with ageing populations, such China and India. Also, the region's market is anticipated to increase as a result of rising healthcare costs, rising awareness of blood disorders, and the availability of sophisticated coagulation analyzers. Furthermore, it is anticipated that the region's growing hospital and diagnostic centre population will further increase demand for coagulation analyzers.

Some of the major players in the global coagulation analyzers market include:

This report offers historical data and forecasts revenue growth at a global, regional, and country level, and provides analysis of market trends in each of segments and sub-segments from 2019 to 2032. For the purpose of this report, Reports and Data has segmented the global coagulation analyzers market based on product type, test type, end-use, and region:

| PARAMETERS | DETAILS |

| The market size value in 2022 | USD 3.84 Billion |

| CAGR (2022 - 2032) | 6.8% |

| The Revenue forecast in 2032 |

USD 6.95 Billion |

| Base year for estimation | 2022 |

| Historical data | 2020-2021 |

| Forecast period | 2022-2032 |

| Quantitative units |

|

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type Outlook, Test Type Outlook, End-use Outlook, Regional Outlook |

| By Product Type Outlook |

|

| By Test Type Outlook |

|

| By End-use Outlook |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America ; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; France; BENELUX; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; Turkey |

| Key companies profiled | Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific, Nihon Kohden Corporation, Instrumentation Laboratory, Werfen Group, Stago, Helena Laboratories |

| Customization scope | 10 hrs of free customization and expert consultation |

Facing issues finding the exact research to meet your business needs? Let us help you! One of our Research Executives will help you locate the research study that will answer your concerns. Speak to Analyst Request for Customization

Request a FREE Sample here to understand what more we have to offer over competition…

upto20% OFF

upto20% OFF

Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles